Tariffs and Trade: The Cost of U.S. Agriculture

Tariffs and Trade: The Cost of U.S. Agriculture

Tariffs are a government tool used to raise the price of foreign products, encouraging consumers to buy domestically produced goods. They serve multiple purposes, including protecting local industries from foreign competition, generating government revenue, and responding to unfair trade practices. This article examines the US export portfolio for corn, soybeans, and wheat, highlighting key countries where retaliatory tariffs could lead to price volatility and losses in agricultural commodities.

Tariffs are a government tool used to raise the price of foreign products, encouraging consumers to buy domestically produced goods. They serve multiple purposes, including protecting local industries from foreign competition, generating government revenue, and responding to unfair trade practices. This article examines the US export portfolio for corn, soybeans, and wheat, highlighting key countries where retaliatory tariffs could lead to price volatility and losses in agricultural commodities.

While tariffs may seem beneficial by offering protection, generating revenue, or as a negotiating tool for broader policy issues, they create winners and losers. When the US imposes tariffs, other countries often retaliate, targeting industries reliant on exports. In many cases, US agriculture bears the brunt of these actions.

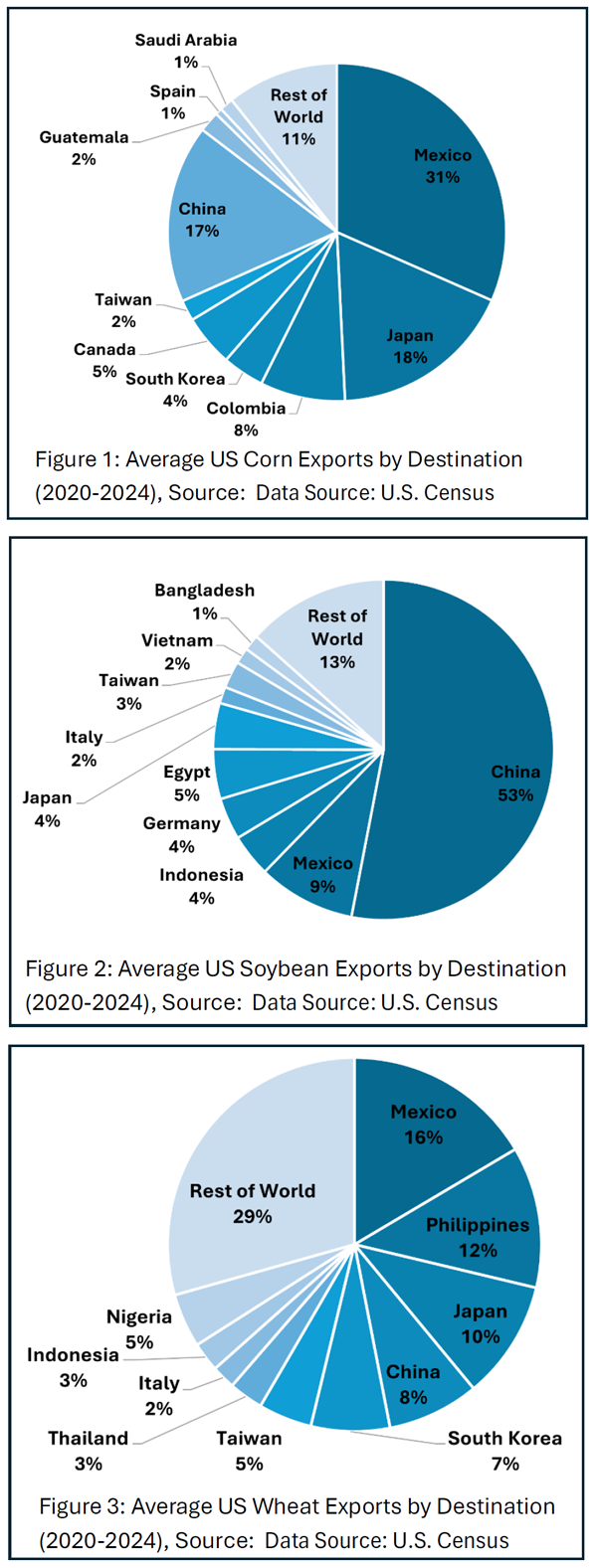

As of March 15, the US has enacted tariffs on Canada, Mexico, China, and the European Union—nations that collectively purchase nearly 54% of US corn exports, 62% of soybean exports, and 24% of wheat exports (2020–2024 average). Additional tariffs have been proposed against Japan, which accounts for 18% of US corn exports, 4% of soybean exports, and 10% of wheat exports. As retaliatory tariffs take effect, US commodities become more expensive internationally which reduces exports and increases domestic supplies, which in turn drives domestic prices down. While these countries may not stop purchasing US crops entirely, they are likely to shift demand toward competing suppliers such as Brazil, Argentina, and the Black Sea region.

Regardless of political perspective, tariffs disrupt free trade, undermining comparative advantage and efficiency. For example, the US holds a comparative advantage in corn production relative to Canada, while Canada holds a comparative advantage in potash production. When tariffs are imposed, the domestic supply of efficiently produced US corn rises, pushing US prices lower. Meanwhile, retaliatory tariffs restrict access to efficiently produced Canadian goods, such as potash, causing their US prices to increase.

While tariffs may provide short-term benefits to certain industries and could serve long-term policy goals, their immediate impact on US agriculture is overwhelmingly negative.

Citation: Gardner G., 2025. Tariffs and Trade: The Cost to US. Kentucky Field Crops News, Vol 1, Issue 3. University of Kentucky, March 14, 2025.

Dr. Grant Gardner, UK Extension Economist

(859) 257-7280

grant.gardner@uky.edu